Do you ask for 'dividend reinvestment plans essay example'? You will find questions and answers on the subject here.

Table of contents

- Dividend reinvestment plans essay example in 2021

- Drip brokerage account

- Automatic reinvestment plan

- Dividend example

- Power of dividend reinvestment

- How to calculate dividend reinvestment plan

- Dividend reinvestment stocks

- Pros and cons of dividend reinvestment

Dividend reinvestment plans essay example in 2021

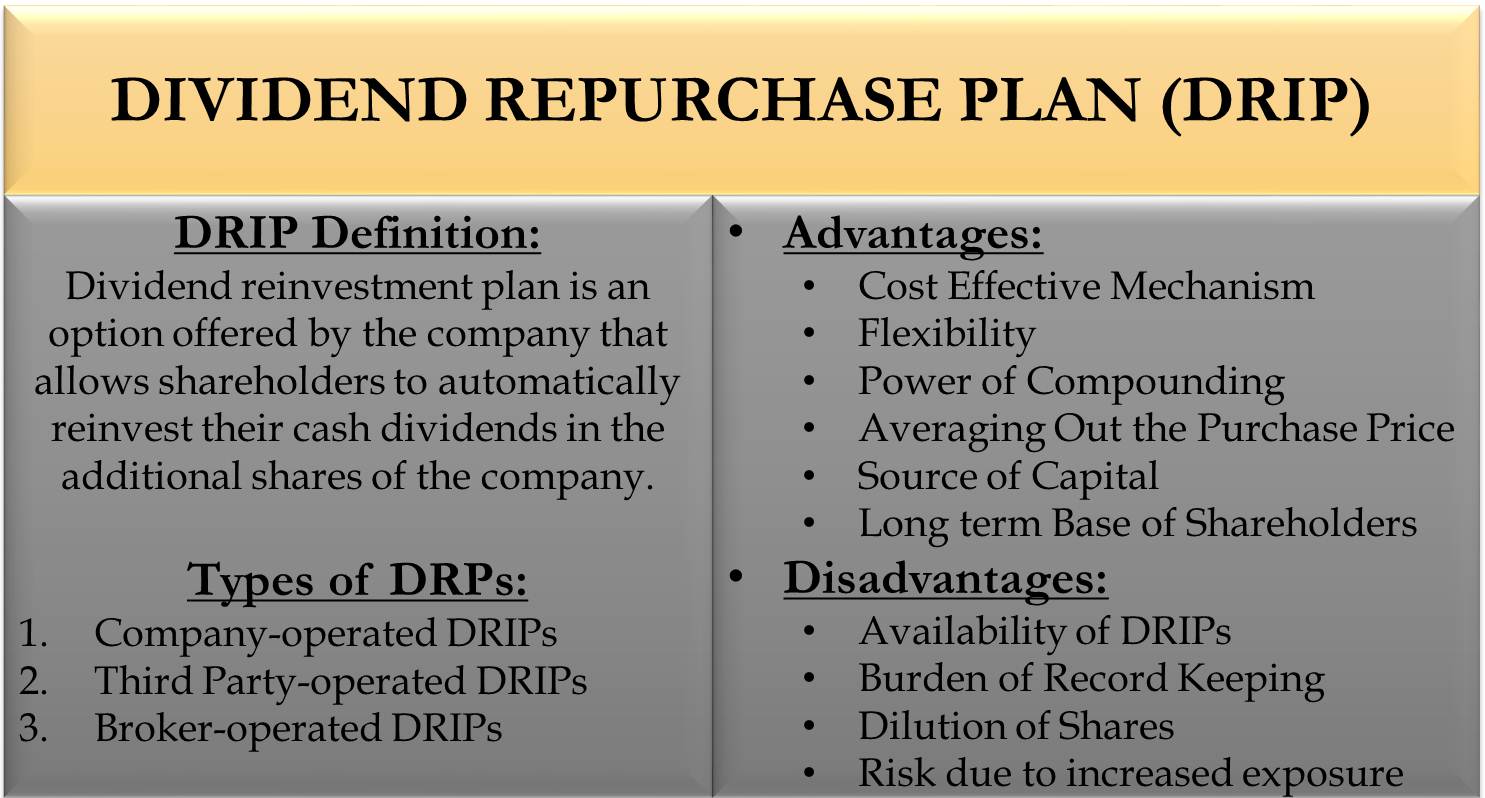

This image demonstrates dividend reinvestment plans essay example.

This image demonstrates dividend reinvestment plans essay example.

Drip brokerage account

This picture illustrates Drip brokerage account.

This picture illustrates Drip brokerage account.

Automatic reinvestment plan

This image demonstrates Automatic reinvestment plan.

This image demonstrates Automatic reinvestment plan.

Dividend example

This picture illustrates Dividend example.

This picture illustrates Dividend example.

Power of dividend reinvestment

This image representes Power of dividend reinvestment.

This image representes Power of dividend reinvestment.

How to calculate dividend reinvestment plan

This picture demonstrates How to calculate dividend reinvestment plan.

This picture demonstrates How to calculate dividend reinvestment plan.

Dividend reinvestment stocks

This image illustrates Dividend reinvestment stocks.

This image illustrates Dividend reinvestment stocks.

Pros and cons of dividend reinvestment

This image shows Pros and cons of dividend reinvestment.

This image shows Pros and cons of dividend reinvestment.

How does a dividend reinvestment plan work?

Mary fully participates in the DRIP, thereby reinvesting 100% of her cash dividends into additional shares of the company. On the payment date, the market share price is $100. With a 15% discount from the DRIP, Mary is able to purchase additional shares at a price of $85 ($100 x 0.85).

How are fractional shares used in a dividend reinvestment plan?

Fractional Shares Fractional share refers to just a part of equity stock which doesn't amount to a single stock unit. Such shares are acquired after stock splits, merger or acquisition, dividend reinvestments, capital gains and dollar-cost averaging.

What is the market value of a reinvested dividend?

You have chosen to participate in its DRP so that 100% of your dividends are reinvested. The company announces a dividend of 15 cents per share. The shares have a market value of $10.50 each. You would normally receive $150 in the form of a cash dividend (1,000 x $0.15).

What are the pros and cons of a reinvestment plan?

Pros of dividend reinvestment plans. Taking the above into consideration, there are a number of advantages that DRPs offer investors, including: Reinvested dividends enable the acquisition of new shares/stocks with no brokerage fees. This makes for a very cost-effective method for buying new shares over time.

Last Update: Oct 2021